What Does 6 Figures Mean In Money? It signifies an annual income ranging from $100,000 to $999,999, a financial milestone many aspire to achieve, and at money-central.com, we’re dedicated to providing the insights and strategies you need to reach that goal. Earning a 6-figure income can be achieved through various paths, including advanced education, strategic career moves, and smart investments, leading to financial independence and a higher standard of living, so explore diverse career paths, investment strategies, and financial planning tips that align with your goals for financial freedom.

1. Defining Six Figures: What Does It Really Mean?

“What does 6 figures mean in money?” It represents an annual income between $100,000 and $999,999. This financial benchmark is often seen as a sign of success and financial stability, opening doors to various opportunities and a comfortable lifestyle.

The term “six figures” is more than just a number; it’s a symbol of financial achievement and a goal for many working professionals, and understanding what it represents and how to achieve it can be a game-changer in your financial journey.

Here’s a detailed look at what a six-figure income translates to in different timeframes:

| Salary Breakdown | Amount |

|---|---|

| Hourly (Based on 40-hour week) | $48.08 – $480.77 |

| Weekly | $1,923 – $19,231 |

| Bi-Weekly | $3,846 – $38,462 |

| Monthly | $8,333 – $83,333 |

| Quarterly | $25,000 – $249,999 |

| Semi-Annually | $50,000 – $499,999 |

| Annually | $100,000 – $999,999 |

As you can see, earning six figures means having a substantial income that can provide financial security and open up various opportunities. Keep in mind that these figures are pre-tax, and the actual amount you take home will depend on your tax bracket and deductions.

2. Who Earns Six Figures? Demographics and Statistics

“What does 6 figures mean in money?” While it’s a desirable income bracket, only a segment of the population achieves it. According to the U.S. Census Bureau, approximately 18% of full-time workers in the United States earn at least six figures annually.

Several factors influence who reaches this income level, including education, occupation, location, and experience, and understanding these demographics can provide insights into the pathways to earning a six-figure income.

2.1. Education

Higher education often correlates with higher earning potential, and according to the Bureau of Labor Statistics, individuals with postgraduate degrees in fields like Science, Technology, Engineering, and Mathematics (STEM) are more likely to earn six-figure salaries.

2.2. Occupation

Certain professions are known for their high earning potential, and these include:

- Medical professionals (doctors, surgeons)

- Lawyers

- Engineers

- Financial analysts

- Technology professionals (software developers, data scientists)

2.3. Location

Geographic location plays a significant role in earning potential, and metropolitan areas with high costs of living, such as New York City and San Francisco, often offer higher salaries to compensate for the increased expenses.

2.4. Experience

Experience is a crucial factor in salary progression, and as professionals gain more experience in their field, their earning potential typically increases. This is especially true in industries where expertise and specialized knowledge are highly valued.

3. The Impact of Education on Six-Figure Salaries

“What does 6 figures mean in money?” Education is a significant factor influencing earning potential, and postgraduate degrees in STEM fields often pave the way for high-paying occupations.

According to research from New York University’s Stern School of Business, in July 2025, individuals with advanced degrees earn significantly more over their lifetime compared to those with only a bachelor’s degree.

The table below shows the median salaries for various STEM-related professions:

| Occupation | Median Salary (2023) |

|---|---|

| Physicians and Surgeons | $229,300 |

| Computer and Information Systems Managers | $164,070 |

| Aerospace Engineers | $126,870 |

| Financial Analysts | $95,570 |

| Software Developers | $120,730 |

While higher education often leads to increased student debt, certain college degrees are worth the investment, including medical degrees, engineering programs, industrial management studies, and computer science degrees.

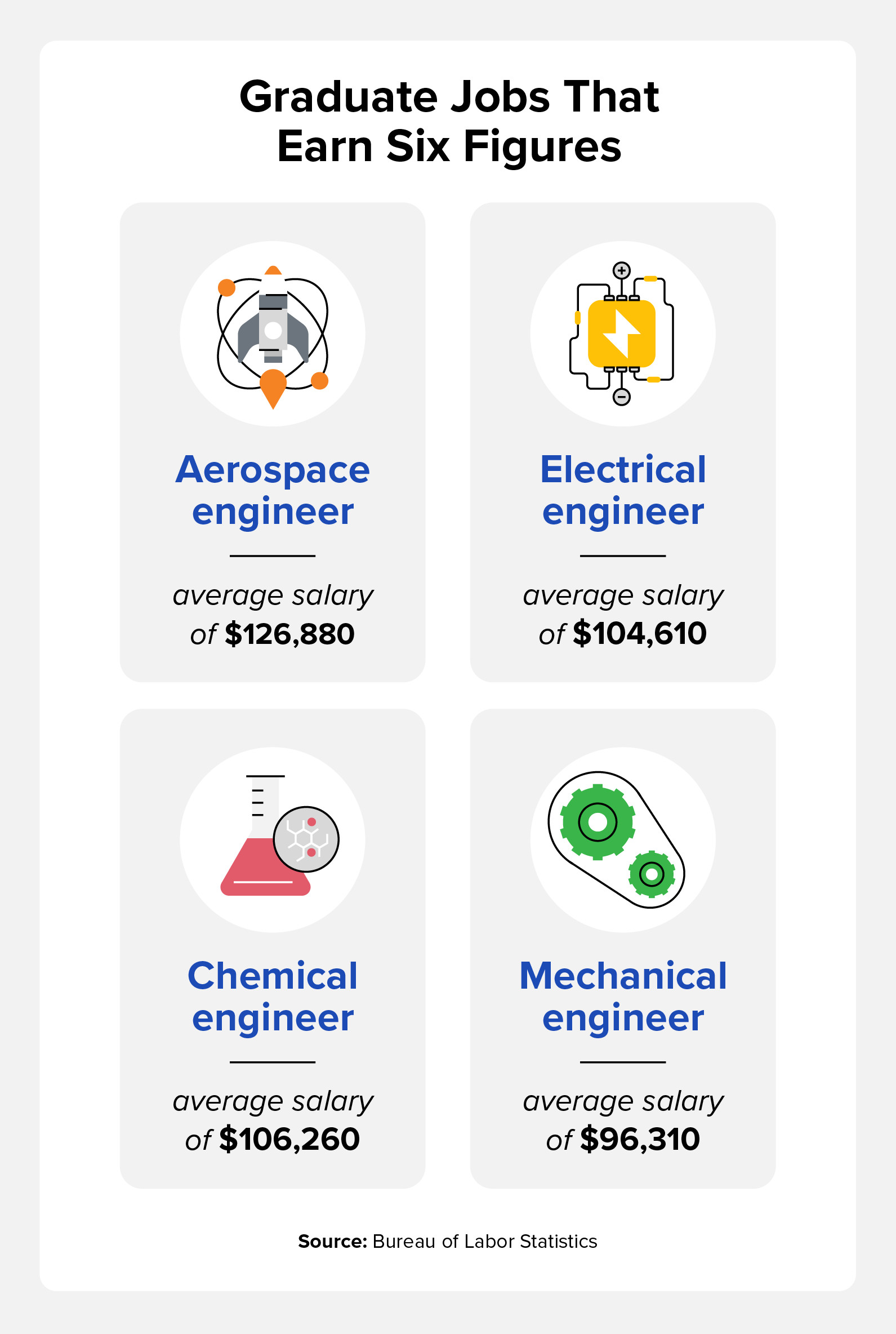

graduate jobs that earn six figures

graduate jobs that earn six figures

4. Can You Earn Six Figures Without a College Degree?

“What does 6 figures mean in money?” While a college degree can certainly boost your earning potential, it’s not the only path to a six-figure salary. Many individuals achieve this income level through vocational training, on-the-job experience, and specialized certifications.

Here are several high-paying occupations that don’t necessarily require a four-year college degree:

4.1. Commercial Airline Pilot

Airline pilots can earn a median salary of $148,900 per year, and while a college degree is preferred by many major airlines, it’s not always a strict requirement.

Securing a pilot’s license and gaining the necessary flight hours and experience are crucial for landing a lucrative position in this field.

4.2. Air Traffic Controller

Air traffic controllers earn about $132,250 annually, and an associate degree is typically required, along with extensive on-the-job training provided by the Federal Aviation Administration (FAA).

The high level of responsibility and focus required for this role justifies the high compensation.

4.3. Police Officer or Firefighter

Police officers and firefighters can earn larger salaries based on their experience and location, and in California, for example, police officers can earn around $117,822 annually, including benefits.

These roles often require preliminary training, certifications, and physical fitness.

4.4. Hard Labor Jobs

Hard labor jobs, such as power plant operators, can pay very well due to the physical risks and technical knowledge required, and in 2022, power plant operators earned a median salary of $97,570.

4.5. Athletes and Sports Competitors

Talented athletes with the proper opportunities can earn a median salary of $94,270, and while world-famous athletes like LeBron James earn millions each year, many others also earn fantastic salaries without a degree.

4.6. Real Estate Agent

Real estate brokers and sales agents can earn six-figure salaries without a college degree, and in California, securing a real estate salesperson license can cost upwards of $500.

Real estate agents primarily earn income from commissions, so building a strong client network is essential for hitting that six-figure mark.

5. Investment Strategies for Earning Six Figures

“What does 6 figures mean in money?” Earning six figures isn’t just about your salary; it’s also about making your money work for you through smart investments. A strong investment strategy, combined with the proper resources and economic conditions, can help you achieve this financial milestone.

Here are some investment options to consider:

5.1. Retirement Savings Plans

Pretax retirement savings plans, such as 401(k)s and IRAs, are excellent ways to save for the future while also reducing your current tax liability, and these plans offer tax advantages that can significantly boost your savings over time.

5.2. Stocks, Bonds, and Treasuries

Investing in stocks, bonds, and treasuries can provide a diversified portfolio with varying levels of risk and return, and stocks offer the potential for high growth, while bonds and treasuries provide more stable income.

5.3. Real Estate and REITs

Real estate and REITs (Real Estate Investment Trusts) can be lucrative investment options, and real estate can provide rental income and appreciation, while REITs offer exposure to the real estate market without the direct ownership.

5.4. Cryptocurrencies

Investing in cryptocurrencies involves substantial risk, given their volatile nature, but some investors allocate a small portion of their portfolio to cryptocurrencies for potential high returns.

Compound interest is a powerful tool for growing your investments exponentially, and compound interest accounts can generate 5% to 8% interest each year based on your retirement investments.

The 401(k) calculator at money-central.com allows you to experiment with multiple scenarios to see how your investments can grow over time.

6. Ways to Start Earning Six Figures

“What does 6 figures mean in money?” If you’re striving to earn at least $100,000 annually, here are some strategies to keep in mind:

- Consider earning a postgraduate degree in a STEM field.

- Avoid student loans to the best of your ability.

- Research vocations that don’t require postgraduate degrees.

- Consider attending a trade school or technical college.

6.1. How to Increase Your Income in Your Current Role

- Consider switching companies every few years, as competitors may pay more for experienced workers.

- Pursue promotions within your current organization whenever possible.

- Explore entrepreneurship once you’ve gained enough practical experience and saved up a set amount of capital.

great ways to earn six figures

great ways to earn six figures

7. Understanding Tax Implications on a Six-Figure Income

“What does 6 figures mean in money?” As your salary increases, so will your tax obligations, and understanding the tax brackets is essential for managing your finances effectively.

Here are the 2024 tax brackets for single and joint filers, as disclosed by the Internal Revenue Service (IRS):

| Percentages | Single Filers | Joint Filers |

|---|---|---|

| 37% | Over $578,125 | Over $693,750 |

| 35% | $243,726 to $578,125 | $487,451 to $693,750 |

| 32% | $191,951 to $243,725 | $383,901 to $487,450 |

| 24% | $100,526 to $191,950 | $201,051 to $383,900 |

| 22% | $47,151 to $100,525 | $94,301 to $201,050 |

| 12% | $11,601 to $47,150 | $23,201 to $94,300 |

| 10% | Up to $11,600 | Up to $23,200 |

Knowing your tax bracket can help you make informed financial decisions, such as adjusting your withholdings or contributing to tax-advantaged retirement accounts.

8. Maintaining Strong Credit While Pursuing a Six-Figure Income

“What does 6 figures mean in money?” No matter how you plan to increase your revenue, maintaining strong credit is crucial, and good credit can help you secure lucrative loans and open doors to higher-paying positions.

With money-central.com’s resources, you can get reliable updates about your credit score and insight into your credit information, along with tools and strategies to help you improve your creditworthiness.

9. Overcoming Financial Challenges on the Path to Six Figures

9.1. Understanding Financial Concepts

Many people find financial concepts complex and challenging to grasp. Money-central.com provides easy-to-understand articles and guides on topics such as budgeting, saving, investing, debt management, and credit scores.

9.2. Budgeting and Expense Tracking

Creating an effective budget and tracking expenses can be daunting, and money-central.com offers budgeting tools and calculators to help you manage your finances more efficiently.

9.3. Investment Strategies

Choosing the right investment strategies can be overwhelming, and money-central.com offers resources and advice on various investment options, from stocks and bonds to real estate and retirement plans.

9.4. Debt Management and Credit Improvement

Managing debt and improving credit scores are common challenges, and money-central.com provides strategies and tools to help you reduce debt and build a strong credit history.

9.5. Saving for Financial Goals

Saving enough money for important financial goals, such as buying a home or retirement, can be difficult, and money-central.com offers resources and calculators to help you plan and save effectively.

9.6. Handling Financial Emergencies

Dealing with unexpected financial situations can be stressful, and money-central.com provides advice on how to prepare for and manage financial emergencies.

9.7. Seeking Reliable Financial Advice

Finding trustworthy and personalized financial advice can be challenging, and money-central.com connects users with reputable financial advisors who can provide tailored guidance.

By addressing these challenges and providing accessible resources, money-central.com empowers individuals to take control of their finances and work towards achieving their financial goals.

10. Call to Action

Ready to take control of your financial future and start your journey towards earning six figures? Visit money-central.com today to access our comprehensive articles, financial tools, and expert advice. Whether you’re looking to improve your budgeting skills, explore investment options, or manage your debt, we have the resources you need to succeed.

Don’t wait—start building your financial success story with money-central.com today!

For personalized assistance, you can reach us at:

Address: 44 West Fourth Street, New York, NY 10012, United States

Phone: +1 (212) 998-0000

Website: money-central.com

FAQ About Earning Six Figures

1. What exactly does earning six figures mean?

Earning six figures means having an annual income between $100,000 and $999,999.

2. What percentage of Americans earn six figures?

Approximately 18% of full-time workers in the United States earn at least six figures annually.

3. Can I earn six figures without a college degree?

Yes, many occupations, such as airline pilot, air traffic controller, and real estate agent, offer the potential to earn six figures without a four-year college degree.

4. What are some of the best investment strategies for earning six figures?

Consider investing in retirement savings plans, stocks, bonds, real estate, and REITs to grow your wealth over time.

5. How does education impact my chances of earning six figures?

Higher education, particularly in STEM fields, often correlates with higher earning potential and increased opportunities for six-figure salaries.

6. What are the tax implications of earning six figures?

As your income increases, so will your tax obligations, and understanding the tax brackets is essential for managing your finances effectively.

7. How important is maintaining strong credit while pursuing a six-figure income?

Maintaining strong credit is crucial, as it can help you secure lucrative loans and open doors to higher-paying positions.

8. What are some strategies for increasing my income in my current role?

Consider switching companies every few years, pursuing promotions, and exploring entrepreneurship.

9. What resources does money-central.com offer to help me on my financial journey?

Money-central.com provides comprehensive articles, financial tools, and expert advice to help you improve your budgeting skills, explore investment options, and manage your debt.

10. How can I get personalized financial advice from money-central.com?

money-central.com connects users with reputable financial advisors who can provide tailored guidance based on their individual financial situations.